The Full Story:

Monday afternoon, I was minding my own business and enjoying my birthday away from the office when the news feed on my phone delivered a present. The Joint Committee on Taxation released a 199-page summary of the House’s new tax proposal. Although it may be less punitive than what we were expecting earlier in the year, it still has plenty of tax increases to go around. We will review some of the more impactful income, estate & gift tax provisions.

Individual Income Tax Provisions

The good news is that if your taxable income is under $400,000 single (S) or $450,000 married filing joint (MFJ), there should be limited impact to your income tax bill. However, if your income is over those amounts, you could see significant changes.

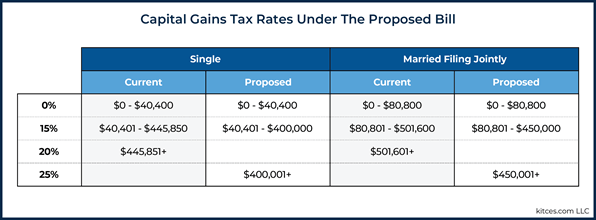

Capital Gains Rates:

The maximum long-term capital gains rate for sales on or before September 13, 2021, remains 20%. However, after September 13, if your taxable income is over $400,000 (S) or $450,000 (MFJ), those capital gains will be taxed at a 25% rate, effectively creating a new long-term capital gains tax bracket.

Net Investment Income Tax (NIIT):

The NIIT rate remains at 3.8% for taxpayers with income over $200,000 (S) or $250,000 (MFJ). However, this bill includes a provision to begin subjecting S Corporation non-wage earnings to the tax.

New Surtax for Ultra High Income:

The bill includes a 3% surtax on Modified Adjusted Gross Income (MAGI) over $5 million. Because it is an income surtax, it will not be reduced by standard or itemized deductions. This distinction could be more punitive than a higher top income tax rate for those ultra-high-income taxpayers with large charitable or other deductions.

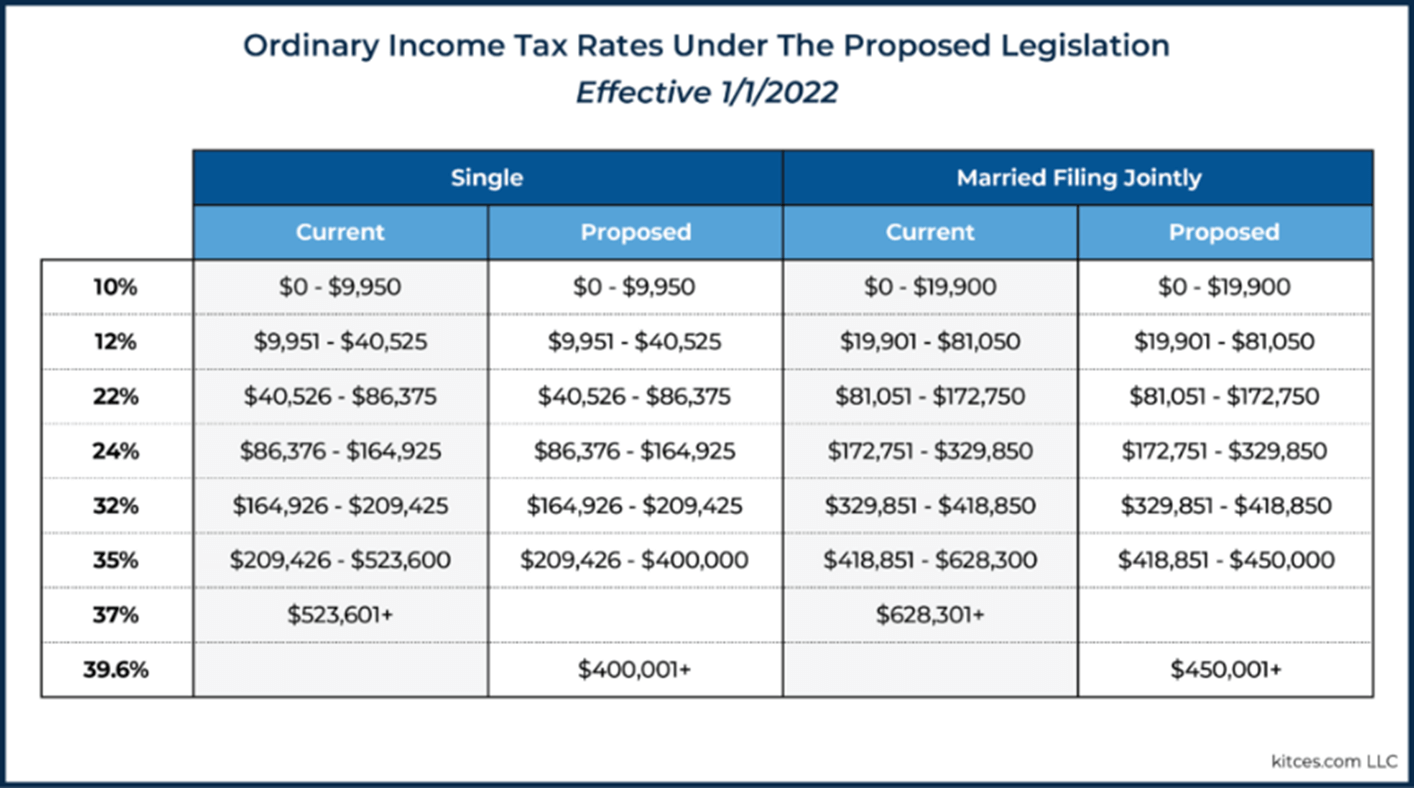

Highest Ordinary Income Tax Rate:

Beginning in 2022, the highest marginal tax rate will increase from 37% to 39.6% for taxable income over $400,000 (S) or $450,000 (MFJ). Not only does this eliminate the 37% bracket, but it also narrows the 35% bracket.

Putting it All Together:

If you were subject to every tax increase listed above, your marginal tax rate on each additional dollar of income would be 46.4% (39.6% ordinary income rate + 3.8% net investment income tax + 3% ultra-high- income surtax). This is harsh enough if you live in Tennessee or Florida, but California residents would add an extra 13.3% in state tax, providing a 59.7% combined marginal federal and state tax rate.

Required Minimum Distributions for Mega Retirement Accounts:

The legislation also includes the “Peter Thiel” rule for individuals with retirement account balances deemed too large. The new rule requires taxpayers with income higher than $400,000 (S) or $450,000 (MFJ) that have more than $10 million total in retirement accounts to take a Required Minimum Distribution (RMD) of 50% of the excess over the $10 million mark. Roth IRAs and 401ks would be included in the mega valuation.

Estate Tax Provisions

There is good and bad news with the estate and gift tax provisions.

First the good news: This proposal does NOT eliminate stepped-up cost basis at death, tax unrealized capital gains at death, increase estate tax rates, or implement a federal rule against perpetuities to eliminate dynasty trust planning.

Now the bad news: The lifetime exemption will be reduced from $10 million (indexed for inflation) back to $5 million (indexed for inflation) effective January 1, 2022, instead of January 2, 2026. More importantly for very large estates, Grantor Retained Annuity Trusts (GRATs), Spousal Limited Access Trusts (SLATs), sales to Defective Grantor Trusts, and Irrevocable Life Insurance Trusts (ILITs) created or funded after the enactment date of the legislation will be included in the grantor’s estate at death, negating the benefit. Please note that any trusts created and funded prior to enactment of the bill will continue to work under current rules. These trusts have provided excellent ways to pass substantial assets to the next generation with little to no estate and gift tax impact, which put them squarely in the crosshairs of tax reform.

In Conclusion:

This legislation is not final and will most certainly change before final enactment. It has limited income tax impact on taxpayers making under $400,000 (S) or $450,000 (MFJ). The estate and gift tax provisions will have limited impact if your estate is worth less than roughly $6 million individually or $12 million as a married couple.

However, if the legislation does impact you, coordinated planning will become much more important. Those who have not used their lifetime exemption and can afford to make gifts between the old $5.85 million and current $11.7 million estate tax exemption, RUN, do not walk, to your planning team to fund GRATs, SLATs, or similar estate planning techniques prior to final enactment of the bill.

Have a great Sunday!

Perry J. Green, CPA/PFS, CFP®, CFA®

Chief Financial Officer, Senior Wealth Strategist