The Full Story:

The combination of Labor Day hangovers, recognition of September’s lousy track record, and recently disappointing economic releases has led to five consecutive days of market selling. This may not sound noteworthy, but there has only been one other five-day sell off so far this year. This market has been remarkably resistant to downforce, but with COVID raging and abundant shortages stunting growth economy-wide, economists have been lowering growth expectations which challenges bullish orthodoxy.

The Atlanta Fed predicts 3.7% GDP growth for the 3rd quarter versus expectations of 6.1% growth as the quarter began. The New York Fed predicts 3.8% GDP growth for the 3rd quarter versus expectations of 5.2% growth as the quarter began. Goldman Sachs recently lowered their full year GDP growth forecast from 6.4% to 5.7%, stating “the Delta variant is already weighing on Q3 growth, and fading fiscal stimulus and a slower service sector recovery will both be headwinds in the medium term.”

As a prelude, we wrote a couple of weeks ago about collapsing individual investor sentiment with the AAII Bears outnumbering the AAII Bulls for the week ended August 18th. We also cited the Bears>Bulls condition as a traditionally bullish indicator for stocks, and indeed stocks rallied to new highs shortly thereafter. However, with the presumably more accurate and dispassionate economist sentiment now collapsing, will our same contrarian optimism hold?

Bad Surprises Lead to Good Surprises

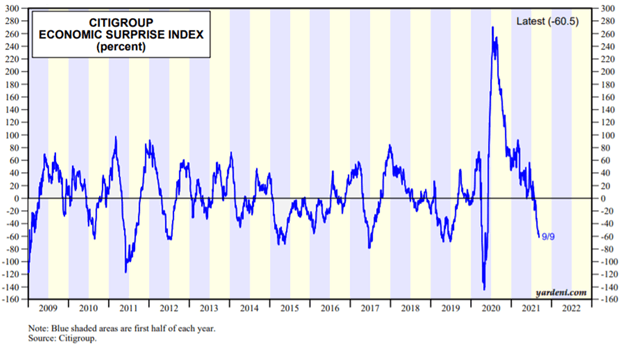

The Citigroup Economic Surprise Index measures the degree to which economic data releases register above or below economists’ expectations. Given the impact of the unforeseen Delta virus, recent data releases have undercut pre-Delta forecasts, leading to a steep decline and a deeply negative current reading in the Citigroup Economic Surprise Index:

At -60.5, the Citigroup Economic Surprise Index has fallen to levels rarely seen. In fact, over the last 15 years, the index has only fallen below these levels three times: during the Great Financial Crisis, the Euro Crisis, and the COVID Crisis.

Now, given the amount of catchup economists had to play by hurrying estimates higher in the roaring post-COVID economy, some overshoot should have been expected. But, faced with a sobering round of negative surprises, economists have cut estimates precipitously, perhaps to the point of overshoot once again. If so, the recent rash of negative surprises that have led to the recent rash of downward forecast revisions simply refills the reservoir for future positive surprises!

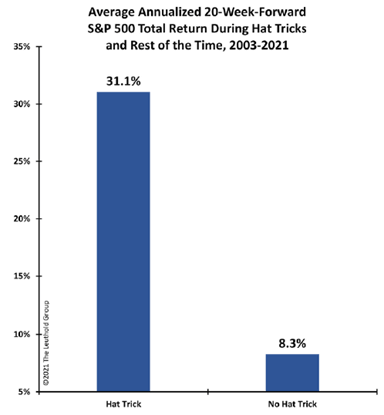

Our friends at Leuthold have also noticed the sizable decline in the economic surprise index, but also highlight the concurrent rise in the US dollar (a risk-off reflex) and reflective decline in industrial commodity prices.

Should the Delta variant downshift nationwide (as it has already in the South), consumer sentiment, service industry economics, and economic data overall should upshift the Economic Surprise Index and industrial commodity prices, while pressing the US dollar lower (a risk-on reflex). In the past, the “Hat Trick” combination of rising economic surprises, rising industrial commodity prices, and a falling US dollar has led to superlative stock market returns:

Things overall could certainly deteriorate from here, and consumer, investor, and economist sentiment indices have all fallen back towards cycle lows in anticipation. Matching up these low sentiment levels with receding Delta case counts and swollen consumer balance sheets entering the holiday season may precipitate surprising results for economists and investors alike. In fact, in addition to cutting their GDP growth estimate for 2021, Goldman Sachs also raised their GDP growth estimate for 2022 from 4.3% to 4.6%. Surprise!

Have a great Sunday!