The Full Story:

Believe it or not, we have completed nearly 50% of 2021. Now that we have reached the halfway point, it is time for a little routine maintenance. This week, we will run a battery of tests on this market and render a diagnosis. Markets have recently broken new highs after a period of indigestion. Are these levels sustainable or vulnerable? It is time for our mid-year physical to find out how healthy these markets really are.

Economy

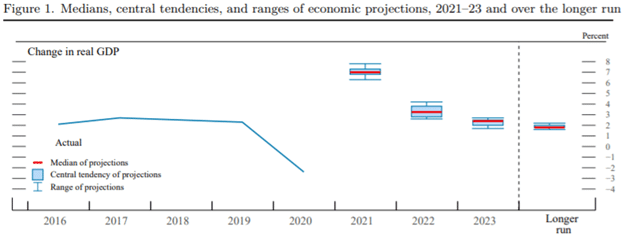

Last week, the Fed released its summary of economic projections (this chart was taken directly from the release; clearly the Fed needs an aesthetician):

According to the FOMC consensus, US GDP will increase an estimated 7% in 2021, 3.3% in 2022, and 2.4% in 2023. These estimates have risen meaningfully since their last release, with the 2021 estimate rising half a percent! Global GDP estimates have also jumped recently. Wells Fargo is now predicting 6.2% global GDP growth, which represents the fastest global growth rate since 1973. Estimates have also risen for various individual nations including Mexico, China, Spain, and others. These alterations tend to correlate with vaccinations. Fifty percent of the US has now been vaccinated versus 22% for the world. As global vaccination rates rise, so will economic potential. Diagnosis: Economic estimates are high and rising.

Inflation

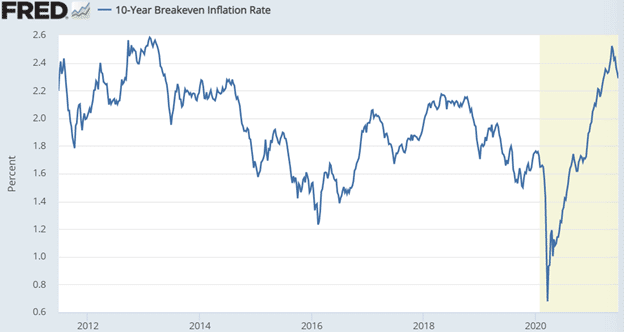

Much has been written about current inflation rates. While areas of recent shortages have led to eye-popping headlines, investors must look further downfield for truer appraisals. The 10-year breakeven inflation rate (market priced inflation expectations over the next 10 years) currently stands at 2.3%, down from 2.5% over the last month as shown below:

This data pattern suggests two things. First, longer duration inflation expectations appear in check, and second, inflation expectations have fallen over the past month as investors have grown more confident in the Fed’s “transitory” inflation outlook. The mere suggestion of a hawkish shift by the Fed last week led to a rapid decline in rates and inflation expectations. If the market worried seriously about inflation, it wouldn’t give the Fed so much credit. Out of control inflation is the Fed’s nightmare, in control inflation is the Fed’s dream. Based upon last week’s market dynamics, inflation still reports to the Fed. Diagnosis: High short-term inflation hasn’t stoked expectations for high long-term inflation.

Earnings

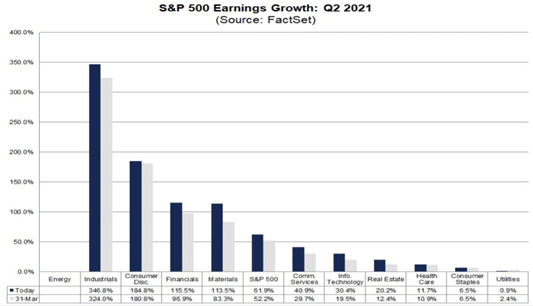

MSCI estimates that global earnings will rise by 39.3% in 2021 and 10.3% in 2022. The estimates for 2021 continue to rise sharply despite the tendency for estimates to fall into release dates. For 2022, estimates have fallen as an offset to the surge in 2021 expectations. However, should global vaccination rates outperform expectations, we should expect global 2022 earnings to outperform as well. In the US, Factset continues to revise earnings estimates substantially higher.

At the end of March, Factset expected 52% earnings growth across the S&P 500 for the second quarter. Three months later, they have revised that number up to 62%. If the current trend holds, this number could also prove conservative. As the first quarter began, analysts expected earnings growth of 23.8%, but by the final count, actual profits rose 52.5%. For the full year, estimates have risen to 35%, up from 26% at the end of Q1. Diagnosis: Earnings estimates are high and rising.

Valuations

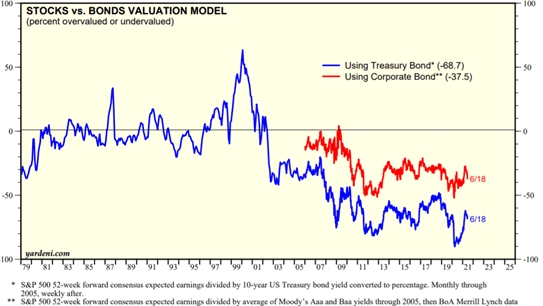

Of all the valuation measures that get debated, in our opinion, only one really matters. Prevailing interest rates determine valuations. Therefore, the difference in the “earnings yield” of the stock market (the inverted P/E) and the interest yield of the bond market properly determines over or undervaluation. With a current P/E of 20.7, the stock market has an earnings yield of 4.8%. Ten-year US Treasury bond yields 1.48%, while Aaa corporate bonds yield 2.7% and Baa corporates yield 3.3%. Which would you rather own?

Based upon this analysis, stocks are 69% undervalued compared with Treasuries and 38% undervalued compared with corporates. Note that in 1999, stocks were 60% overvalued compared with Treasuries, making the popular bubble P/E comparisons meaningless. Now, should Treasury yields spike, valuations could come under pressure. However, as inflation expectations have fallen, so have yields, and plenty of valuation disparity remains. The 10-year Treasury topped out recently at 1.74% on March 19th. Today, the 10-year Treasury yields 1.48%. Diagnosis: Stock valuation comparisons support current levels and can even withstand meaningfully higher interest rates.