The Full Story:

This week, President Biden announced his proposal to raise capital gains taxes from 23.8% to 43.4% for those with earnings (wage income + investment income + capital gains, etc.) above $1,000,000. This follows his previous proposal to raise corporate tax rates from 21% to 28%. In percentage terms, this translates into a 33% increase in corporate taxes and an 82% increase in capital gains tax, the highest level in US history. Some may argue that few Americans statistically make more than $1,000,000 in a year, and that’s true. But it’s also important to note that the top 10% of Americans by net worth own 87% of the stock market. Therefore, while the tax may only impact a small percentage of households, it impacts a large percentage of markets. With the government recently stumping for $2 trillion more stimulus to offset COVID’s economic impact, why now increase taxes at such an historic degree?

The GINI Coefficient

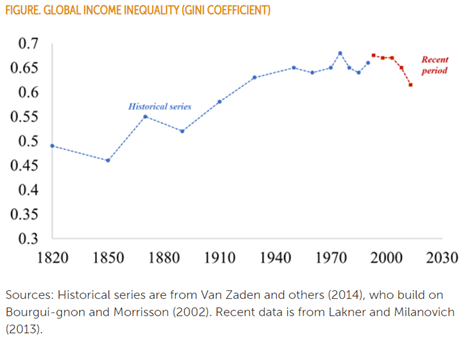

Economists often measure wealth distribution across an economy using the GINI coefficient. Without digging deeply into the math, a GINI coefficient of zero means everyone earns the same thing, while a GINI coefficient of one means one person earns everything. If a nation’s GINI coefficient rises over time, then quantitatively, its income inequality is rising. If a nation’s GINI coefficient falls over time, then quantitatively, its income inequality is falling. To help baseline, economists estimate a global GINI coefficient of around .6. The image below details trends in income inequality globally:

Income inequality globally grew meaningfully up to the year 2000 as economic growth among advanced economies outpaced economic growth among emerging economies. This trend reversed as China ascended and emerging economies began growing faster than the developed economies. According to the GINI coefficient, not only has the world gotten richer over the past two decades, it has become more inclusive as well. Therefore, one way to shrink your GINI coefficient is by disproportionately enriching your poor. Another way to shrink your GINI is by restraining your rich. For instance, the Ukraine boasts the world’s lowest GINI at 25. However, average household wealth in the Ukraine totals $8,792 compared with $432,500 for the United States. Lastly, if you really want to decrease your GINI, just highly tax larger estates. Japan has the world’s highest estate tax and a GINI coefficient roughly half of the world average.

Bringing it Home

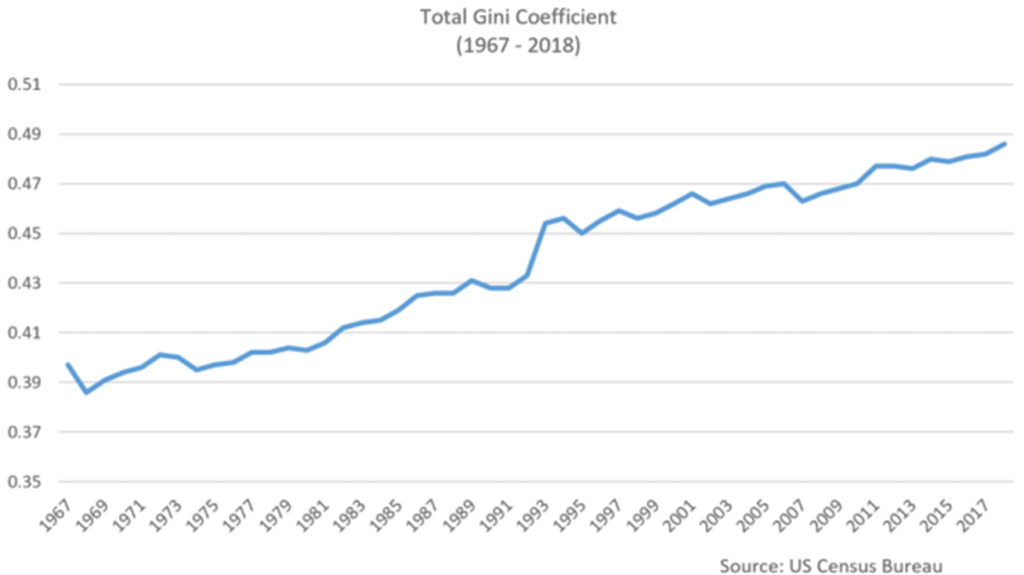

Here in the United States, while our overall inequality score bests the world averages, our coefficient has been rising somewhat consistently:

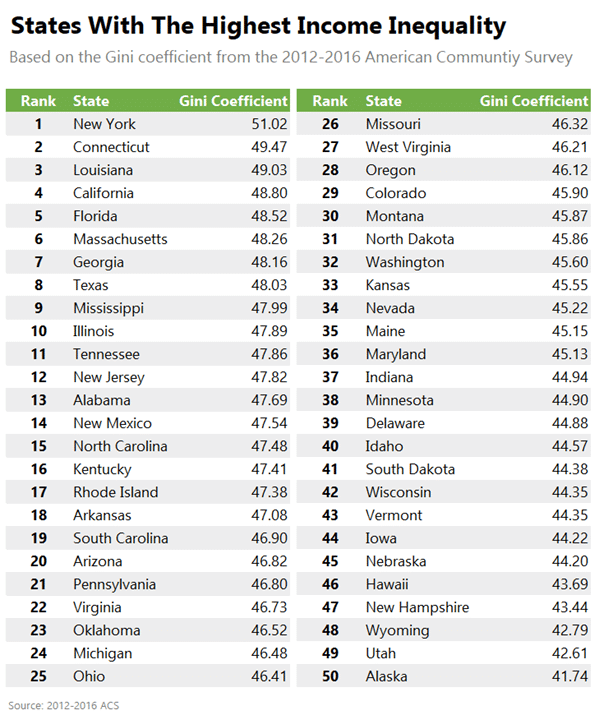

The increase in the GINI coefficient and the disproportionate increase in visible wealth for the top 1% correlate with the rise in political animosity around wealth inequality. Class struggles throughout history have led to conflicts, revolutions, and regime changes. The pressure within the US isn’t novel. Fortunately, we use ballot boxes rather than bayonets to adjust course… and so we have. Biden’s tax proposals aren’t aiming at deficit reduction, they are aiming at GINI coefficient reduction. To evaluate the use of the tax code as a regulator of GINI coefficients, let’s compare the GINIs of each state:

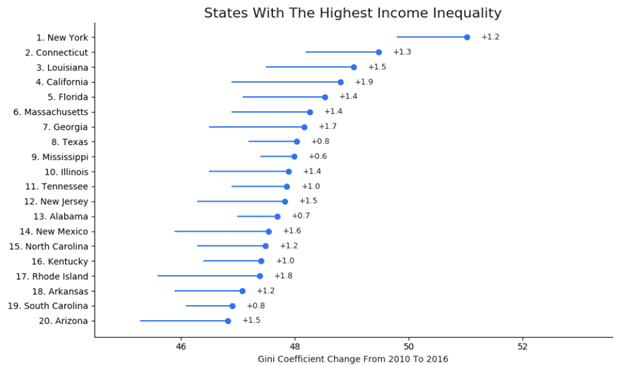

Based upon the state rankings, New York State has the highest income inequality while Alaska has the lowest income inequality (State-Local Tax Burden Rankings | Tax Foundation). New York also has the highest state tax rates while Alaska has the lowest. A quick glance at the rankings makes it clear that overall tax rates have little at best, or negative at worst, correlations with GINI coefficients. Therefore, on their own, higher taxes don’t seem to reduce wealth inequality. For further evidence, in the most progressive tax locations, inequality measures have risen more rapidly on average:

Given that higher tax rates do not seem to cure income inequality, we need to identify policies that do.

Prior to COVID, the US unemployment rate dropped to 3.5%, its lowest level in more than 50 years. For the full calendar year of 2019, median household incomes across America grew 6.8%. Incomes for white Americans grew 5.7%, while incomes for black Americans grew 7.9%. Incomes for women grew 7.8%, while incomes for men grew 2.5%. Poverty levels across the US, overall, fell 1.3% to 10.5%, the lowest level since 1959. Poverty rates for blacks and Hispanics reached their lowest level ever recorded.

Policies that promote economic growth have the best record of reducing poverty and income inequality. The Federal Reserve fully understands this. Their insistence that the economy exceed previously ascribed maximum employment thresholds, and run higher than previously tolerated inflation levels, directly targets poverty reduction and income inequality. If the economy could repeat its recent anti-poverty performance for an extended period, real structural improvements would occur organically across the economy. Tax revenues would rise naturally as a result and employers would deliver job training driven by scarcity and necessity. If you want to defeat poverty…you have to enrich it with capabilities, opportunities and self-sufficiencies.