The Full Story:

The Fundamental

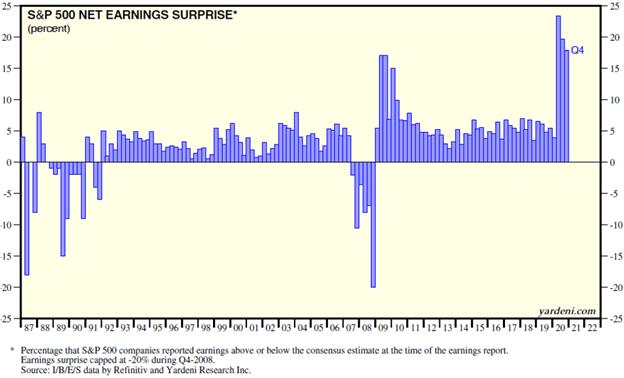

First, take a look at fourth quarter earnings season so far:

Not only are companies beating estimates by a record percentage (86%), they are eclipsing those estimates at near record levels (18%). The fundamental story of this market continues to absolutely crush expectations. This will continue, and resoundingly supports our intermediate-term bullish thesis. Now on to less useful but more interesting things!

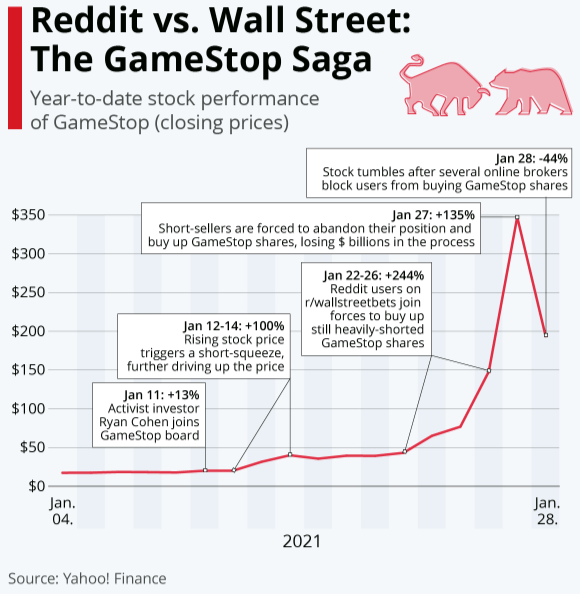

GameStop operates over 5,500 stores nationwide and sells gaming consoles and game cartridges. Given the migration of gamers online, the game hardware business has collapsed. Over the last two years, GameStop has closed 783 stores with plans to close 1,000 more. Corporate revenues fell 30% in the most recent quarter, leading to $19 billion of losses for the bottom line.

Quite literally, GameStop is a loser.

Just as the market has players betting on winners (like W&A), other players like Jim Chanos of Kynikos bet on losers. Jim became the most famous short seller after presciently shorting Enron in 2001, and others like Commodore, Sunbeam, Boston Chicken, Tyco, Wirecard AG, and Hertz during his career. Jim started sounding the alarm on GameStop about ten years ago. He considers himself the Sherriff of Wall Street and has made $1.5 billion for himself while calling out fraud and bad business models for the benefit of his billion- dollar hedge fund clients.

Truth be told, I find profiting off of misery a bit distasteful. But to be honest, all investors are short sellers to some degree. By not owning a stock, you are essentially betting against it. W&A clients do not own GameStop. We have not actively bet against it, but we have passively bet against it by allocating our capital elsewhere. Active short sellers can and do influence/manipulate markets by talking down stocks, but long holders also do this by talking UP stocks. For example, Elon Musk famously tweeted the following in 2018:

Tesla’s stock price jumped 11% in response, costing short sellers like Jim Chanos $1.3 billion that day. In fact, Chanos, a long-time Tesla skeptic, retorted “the short position is the best thing the stock has going for it. “Musk vs. The Shorts” is a far better narrative than “Tesla vs. Mercedes/Audi/Porsche”.

Battles between longs and shorts, optimists and pessimists, believers and non-believers are as old as time. That’s what makes a market. What’s playing out in GameStop is no different. And remember, for everyone who loses money, someone makes money: and if you want to make big short-term profits, you have to take big short-term risk. When this saga ends, we should congratulate the winners and sympathize with the losers. As always.

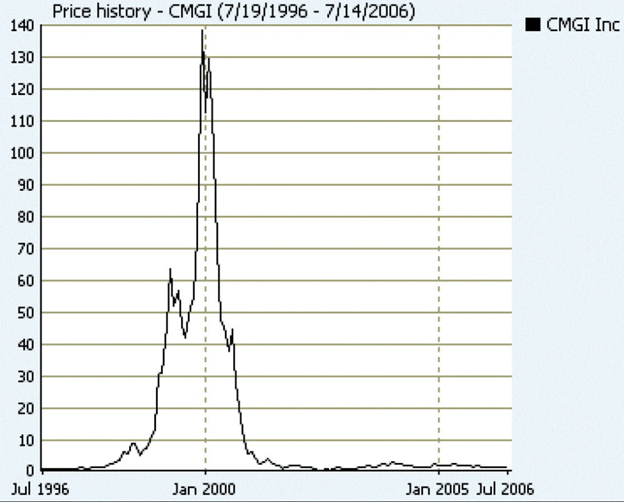

The politicians that see this as an opportunity for airtime need to stand down. Illegal activities should always be prosecuted, but nothing happening between the WallStreetBets vigilantes and the hedge fund shorts is illegal. Calls to restrict market access to “protect” investors from speculators are frightening. Imagine a group of elected officials determining which of the 6,000 stocks that trade daily are speculative and need regulating. That’s inane. I began my career answering the phones in a call center for Charles Schwab on the day Netscape went public. Over the next five years, betting on .coms, I grew my $1,000 IRA into a $120,000+ IRA for a 160% annualized rate of return. My last great investment play was CGMI, a .com incubator in Boston – chart below:

A few months later, my $120,000 IRA became a $1,000 IRA. I lost a lot of money on that trade. I also learned a lot of lessons from that trade. I am a better money manager because of that trade. Had the government stopped me, I might have learned the lesson later with someone else’s IRA. Had the government re-imbursed me for my losses, I would have done lots more of those trades. I am grateful for that lesson… and all of you should be, too. I say, keep the refs away, and let them play!

How We Make Money on Manipulation

I am often asked if I think the market is manipulated on a daily basis. My answer: ABSOLUTELY! Powerful forces from high-frequency traders, investment bank sales sharks, hedge fund grifters, and Reddit rioters interfere, dislocate, create and profit off of mayhem. Our job as long-term money managers, is to capitalize on it.

Hypothetically, let’s imagine that the 2021 “eat the rich” short squeeze of GameStop led to the collapse of the RobinHood brokerage firm. Panic and liquidation would lead to a powerful market downturn (likely the source of Friday’s sell off). We would quickly assemble our investment committee, book any tax losses available, and aggressively look for opportunities to put sideline cash to work. Why? Because the current uptrend in the economy and earnings will persist despite a flash financial panic caused by high volume trading in GameStop (see the earnings chart in my News intro).

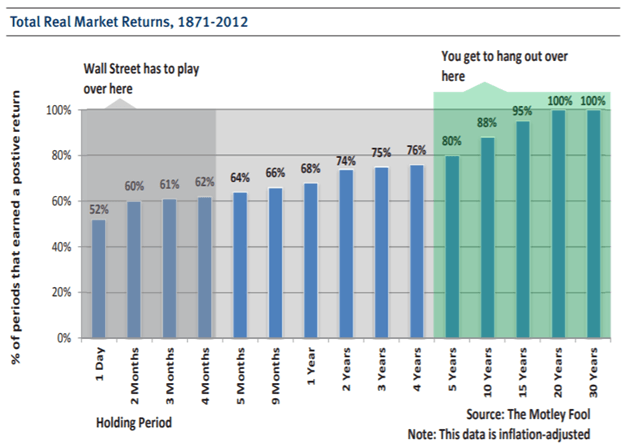

The lunacy of short-term investors creates opportunities for long-term investors like W&A. On a daily basis, it’s the whirlwind of news, misinformation, manipulation, fads and fantasy that direct the tape. Over longer periods, it’s economics and earnings trends that determine market levels. Look at the trader’s traffic on the left side of the chart below and W&A’s client traffic on the right:

On a one-day basis, the stock market is a coin flip. On a 20-year basis, it’s a sure bet. By capitalizing on short-term trading dislocations, we can improve the odds even further. In sum, we use market manipulations to improve our odds.

Have a great weekend!

David S. Waddell

CEO, Chief Investment Strategist