The Full Story:

As Benjamin Graham famously quipped (according to Warren Buffett), “in the short run the market is a voting machine, but in the long run it’s a weighing machine.” To translate, over longer periods of time, fundamentals like economic growth rates, interest rates and corporate earnings determine price levels. Over shorter periods of time, tastes and preferences determine price levels. Despondent investors tend to underprice assets (see March 2020), while euphoric investors tend to overprice assets. Consider Snowflake, one of the top vote-getters of the “ stay-at-home trade” that has cat nipped euphoric investors this year. Snowflake provides data management and analytics services on a SaaS platform within the cloud. I’m not sure what that means, and most investors probably don’t either, but it sounds exciting! So exciting, in fact, that Snowflake has a $100 billion market cap with only $500 million in sales. Therefore, the company trades at 200x revenues vs. roughly 2x for the S&P 500. Maybe Snowflake should rival IBM’s market cap, even though IBM has $75 billion in sales… but maybe not. Only time will tell. The point is enthusiasm and euphoria can push prices up to dizzying heights. With markets trading at all-time highs, has the market reached such a point overall?

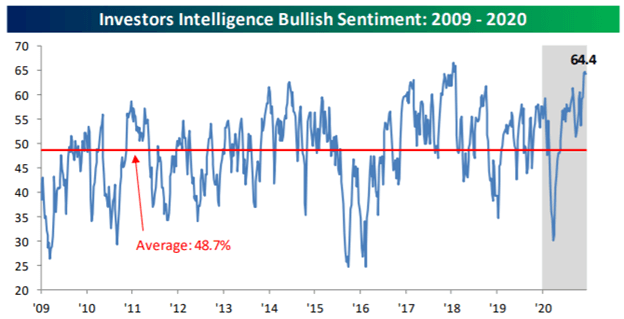

The Investors Intelligence Sentiment Index provides weekly insight into the bullishness of an index of newsletter writers, a proxy for “professional” investors. Those of you who follow our commentary know that we have been resolutely optimistic about the prospects for this market throughout the COVID crisis. In fact, we saw COVID as a catalyst for unprecedented monetary and fiscal stimulus that would ultimately mix with post-vaccine animal spirits to drive markets to all-time highs. As contrarians by nature, we prefer environments where we hold the minority view. It’s the conversion of the skeptics that brings fresh money in to power markets higher. Better to be early than late in this business! Unfortunately, at the current moment, the Investors Intelligence Sentiment Index reports professional investor bullishness near historic highs:

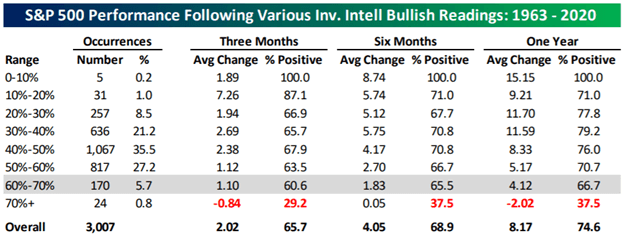

The historic returns that tend to follow readings of this elevation are disappointing:

Clearly, our contrarian thesis plays out. Higher sentiment readings produce lower forward returns just as lower sentiment readings produce higher forward returns. When bullishness has risen to between 60-70%(as it has 170 times in the past), forward returns have been positive… but meager.

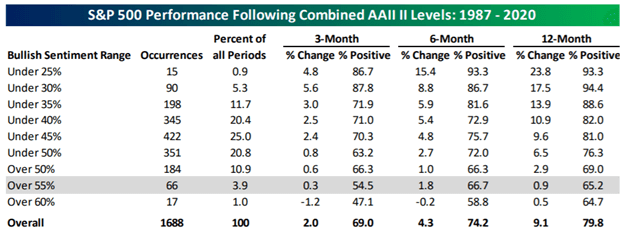

We also track the American Association of Individual Investors sentiment survey. This index polls “amateur” investors who have viewed the COVID rise with a higher degree of skepticism than the professional investors… providing us some contrarian comfort. Recently, however, amateur investors have become more bullish as well. AAII bullishness recently hit 56%, while bearishness dwindled down to 25% (the remaining respondents were neutral). High levels of professional investor bullishness matched with high levels of amateur investor bullishness suggests full equity allocations and diminished cash piles. Without stockpiles of latent cash, stock prices should struggle for advancement. Bespoke Investment Group combined both the professional and amateur indices to enhance their predictive power:

Once combined, we find current sentiment levels in the top 4% of the 1688 surveys counted. Forward returns, while positive overall, remain meager and even more so, with the S&P 500 returning less than 1% over the next twelve months.