The Full Story

This past market week contained welcome and notable jousting between good news and bad. The US became the location of the highest cumulative COVID fatalities, but the daily rate of change has slowed. The IMF predicted a historic global recession for 2020, but also a historic global recovery in 2021. The $350 billion PPP small business loan program ran out of funds, but the $600 billion “Main Street” lending program began allocating funds. March clothing store sales fell 51%, restaurant sales fell 27% and auto sales fell 26%, but non-store retailer sales rose 3%, and food and beverage store sales rose 26%. Unemployment claims topped 5 million this week, but lower than the nearly 7 million in claims two weeks ago. The newfound injection of “but” into the news cycle and the crest in some key health and economic curves validates the recent recovery in investor sentiment and security prices. In fact, at 23,890, the Dow Jones Industrial Average now sits precisely halfway between its 29,568 high and its 18,213 low. Now that the market has rallied and held, it’s time for the real world to start looking up.

The Re-Opening

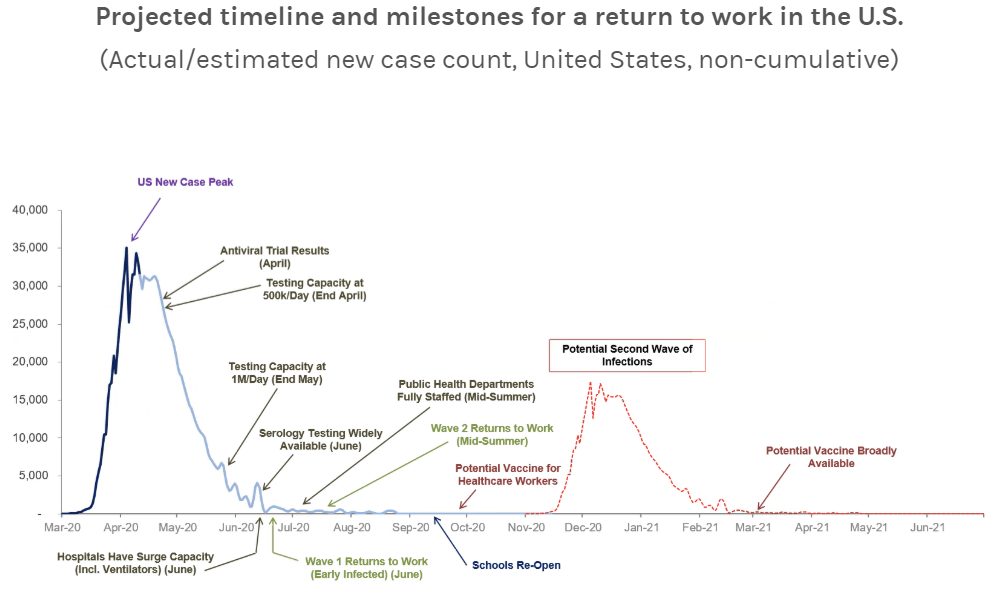

Morgan Stanley released a reassuring graphic this week which forecasts a reopening timeline that’s consistent with our own projections:

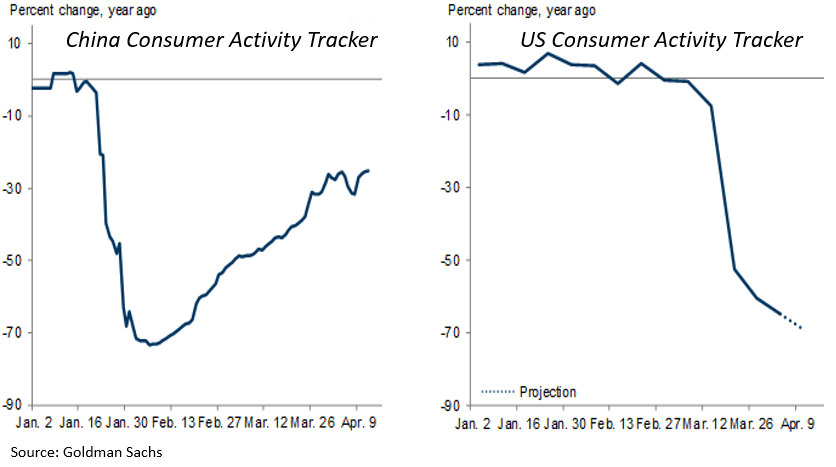

To complement this map on pace, we also need to estimate the potential thrust of economic recovery. For this we have data given that China’s COVID experience leads ours by about 3 months. New case counts in China reportedly peaked February 4th, thanks to a then unprecedented national quarantine. As a result, Chinese GDP shrank 6.8% in the first quarter, deviating substantially from China’s 6% pre-corona run rate. This 13% swing roughly approximates expectations for 2nd quarter GDP losses in the US. Today, consumer activity in China has reclaimed over 70% of pre-corona levels. Should US new case counts begin to flatten soon, we could see a meaningful recovery in domestic consumer activity levels by late July or early August. Note the China vs. US consumer activity timeline comparison below:

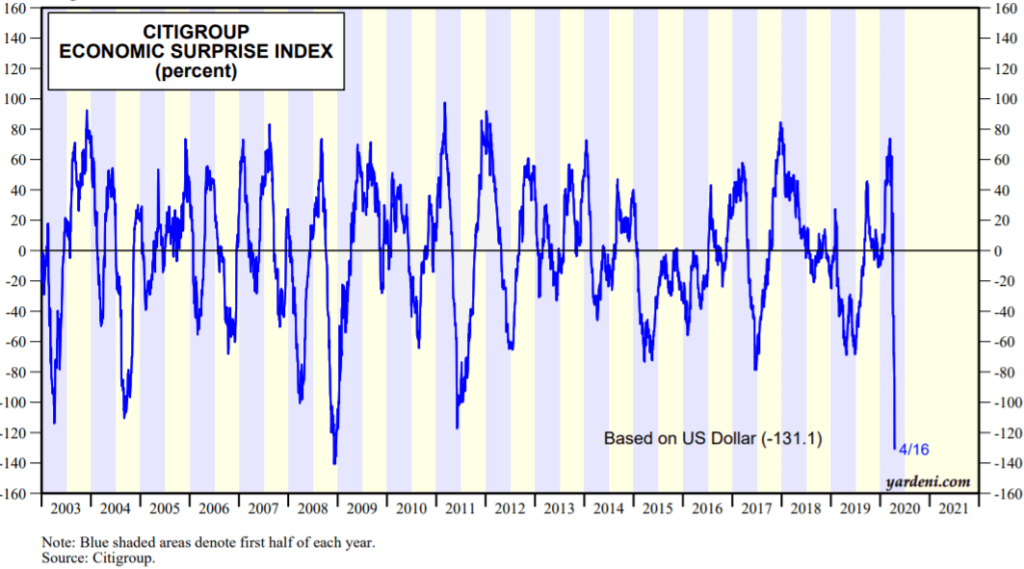

To most, this likely feels too optimistic. Fortunately, economic expectations have dropped to historically surmountable thresholds:

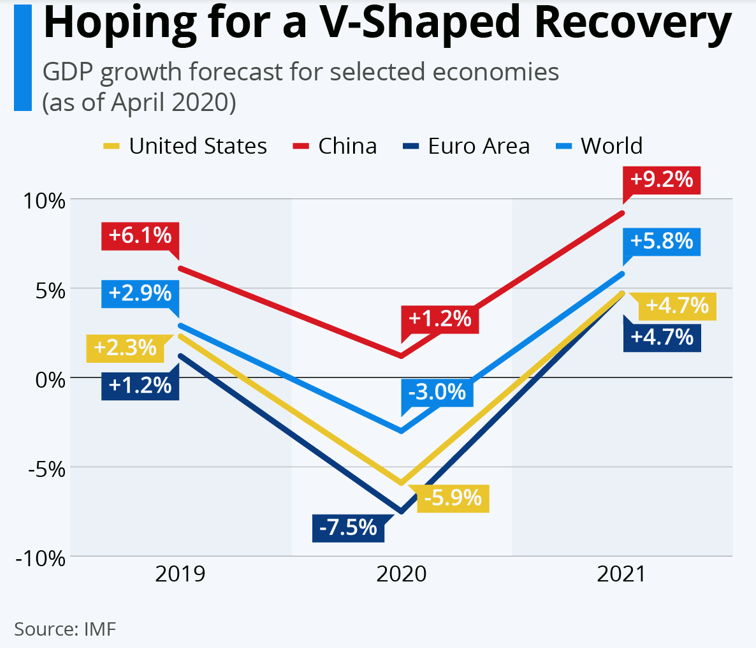

When economic reports come in worse than expected, this economic surprise index falls. When economic reports come in better than expected, this indicator rises. Analysts hate surprises. Consistent undershoots drive them to quickly lower their estimates, pouring the foundation for upside surprises, and vice versa. At this point, estimates have fallen like a stone, with some predicting depression-like outcomes for the US economy. Should history repeat and reality beat record low expectations, investor and consumer confidence could see substantial lift. Given that economies run on confidence, any meaningful uptick in optimism should translate into an uptick in already pent-up consumer demand and perhaps an accelerated recovery. In anticipation, I will leave you with an another encouraging visual thanks to the IMF’s updated economic outlook released on Tuesday:

Note that according to the IMF, the global economy will reclaim new heights by the end of 2021. Returning our focus to China, the IMF predicts Chinese GDP will surge 9.2% in 2021 after idling in 2020. This rosy forecast incorporates 3 months more data than any other COVID-stricken economy can provide at this point. For the US, the less informed outlook also seems less promising, with a 4.7% rebound following a 5.9% decline. What would surprise forecasters is not a pace slower than this, but a pace faster than this. Which is why it just may be more likely.