The Full Story:

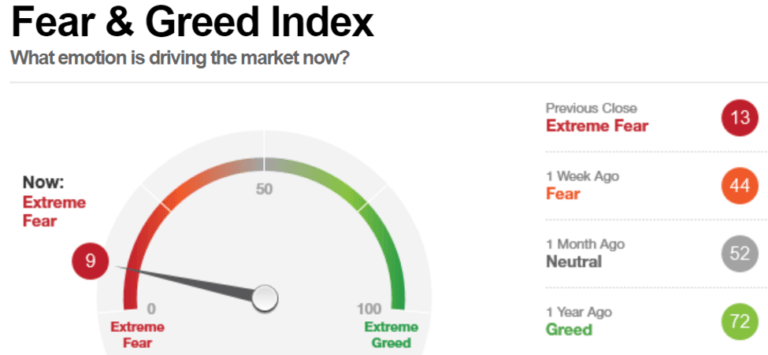

Welcome to yet another freaky weekly wrap up. Markets hit the panic button this week as the migration of the coronavirus from far away China, to not so far away California, infected investor confidence. From its high on February 12th to its low this past Friday, the Dow Jones Industrial Average shed 4,888 points or 16.5%. Not only did Thursday’s total point decline set a record, but the speed of this collapse rivaled ominous events like the 1987 crash, the Great Financial Crisis, 9/11 and WWII. I am actually sitting in the Atlanta airport as I type, and every conversation seemingly starts and ends with the coronavirus. A friend of mine from England just texted me pictures of empty pharmacy shelves in reaction to a recent local diagnosis. Whether we have reached the market bottom or not, we may be closing in on a top in fear. Fortunately, CNN has a handy greed/fear index to quantify the anxiety. Here is the current reading:

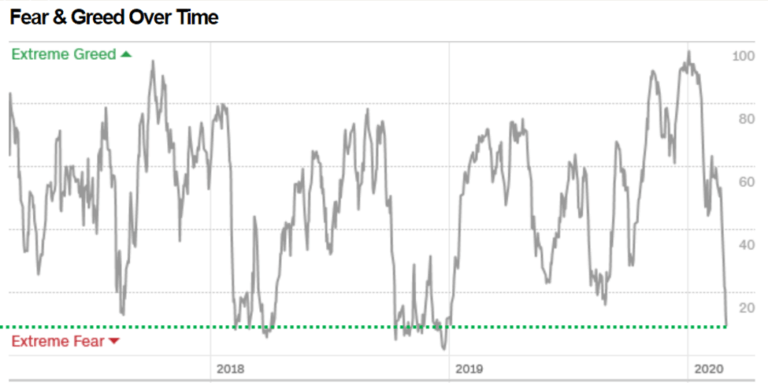

Yikes! Nine out of 100 is a pretty rare low. In fact, that’s the lowest level we have seen since late 2018 when a tone-deaf Fed and a bellicose trade war were seemingly conspiring to put the world economy into recession:

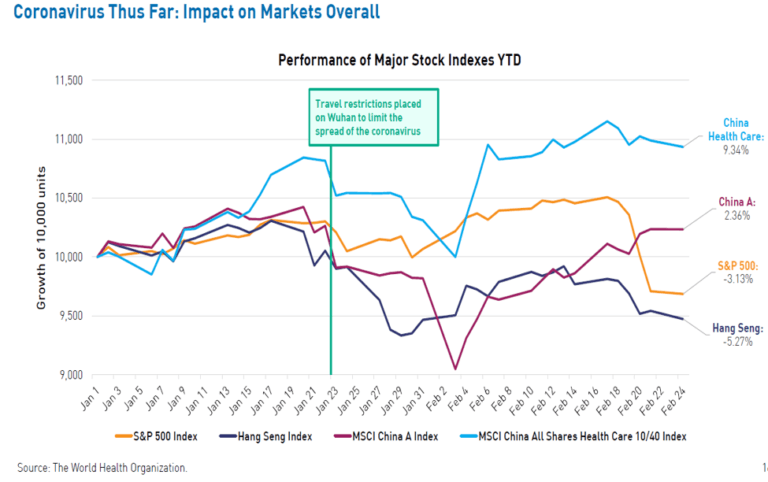

While I may lack qualification to discuss pandemic possibilities and probabilities from here, I have attained qualification to discuss investment possibilities and probabilities from here. For that analysis, we must more closely examine the relationship between the virus and markets at the source. The Chinese investors were the first into this mess and should be the first out. A recovery for Chinese investors could, therefore, foreshadow recoveries for investors outside of China.

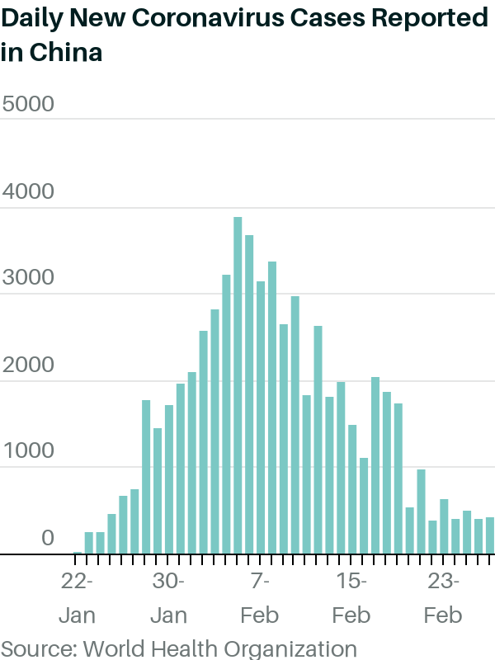

There are three ways to combat the coronavirus. To thwart infection, you need a vaccine. To prevent the spread, you need to quarantine. To prevent fatalities, you need an antidote. Given the speed of contamination, the Chinese did not have time to develop, distribute and administer vaccines or antidotes. This left quarantine as their only available response. Love it or hate it, their authoritarian political structure makes them quite capable of enforcing quarantines. They shut down the entire Hubei province, they erected transportation checkpoints, they built barricades to prevent unauthorized migrations, and they assembled CV-only treatment facilities in days. And it worked! Through draconian quarantines, the Chinese managed to lower their daily case confirmations from nearly 4,000 in early February to around 300 today. While these measures imposed notable costs on their economy, they also managed to dramatically reduce contamination risks for their citizens.

Comparing the chart above with the chart below of the local Chinese stock market (the red line), we see that they mirror each other. A rise in cases above leads to a fall in prices below, while a fall in cases above leads to a rise in prices below.

Note that the US markets seemingly lag the Chinese A markets by about a month, roughly the amount of time it took for the coronavirus to get from China to California.

Case counts in the US and the rest of the world will grow. Quarantines outside of authoritarian China will likely be less effective. Fortunately, here in the US, drug makers Moderna and Gliead have vaccines and antidotes in human trials. The moment these countermeasures prove effective and distributable, case counts will drop (or become less alarming), confidence will return, and markets will rally. Don’t take my word for it, just ask the Chinese.