The Full Story:

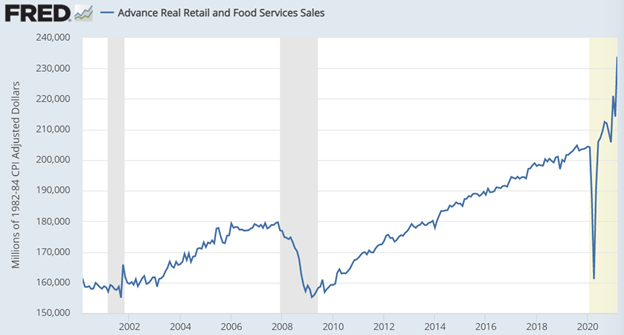

Spring is in the air! It’s also in the economy, and in the markets. While I live amongst the data feeds, I also occasionally live in the real world. Fully vaccinated and emboldened, I’ve hit five airports over the last week. The airports, rental car counters, hotels, and restaurants were overrun. Each seemed unprepared and understaffed for the surge I saw. As pent-up demand and government stimulus blast into the economy, businesses will scramble to scale up hiring and inventory levels. Supply dislocations will lead to resource scarcities, pricing pressures, and upsized factory orders. In other words, revenues will surge while expenses lag, leading to surging margins and exponential profit growth. Just to corroborate my anecdotal travel take, consider the retail sales data released this week for context:

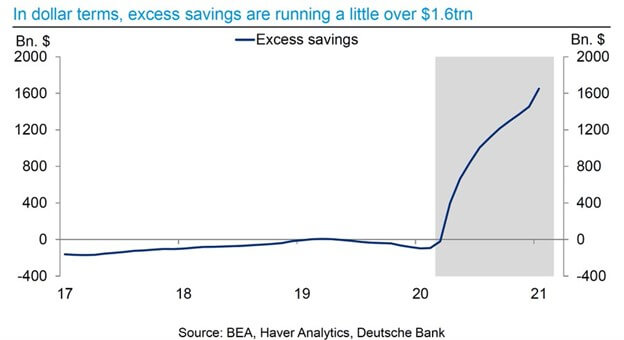

For February of 2020, at the pre-pandemic high, US retail sales totaled $204 billion. Compared with February of 2019, that amounted to an increase in retail sales of 2.3%. Thirteen months and one pandemic later, retail sales have risen 14.5% between February 2020 and March 2021. If you compare this March to last March, sales are up 25%. If you compare this March to the April 2020 low, sales are up 45%. The US economy has NEVER seen this rapid an increase in demand. Furthermore, this initial surge will likely persist given the excess accumulated savings in consumer’s pockets:

The data above accounts for the emergency unemployment benefits paid to date, the first stimulus checks of $1,200 and the second stimulus checks of $600, but not the third stimulus checks of $1,400 spraying out now. Estimating a current $2 trillion in aggregate excess savings, consumers are sitting on additional spending power worth roughly 10% of total US GDP. Meting this out over three years would alone grow the US economy at 3%+ annually. However, given our history of consumptive impatience, expect sizable and surprising front-loaded gains. Get ready for a status quo of superlatives.

Profits Generate More Profits

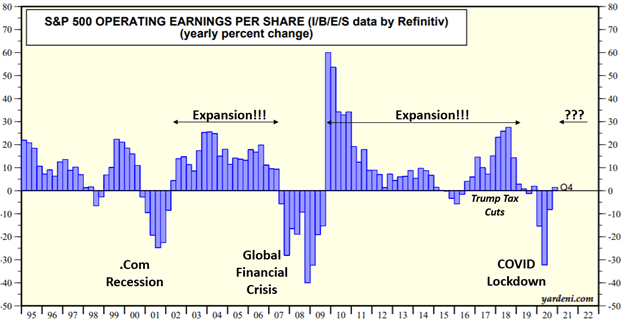

To quantify the profits misery of 2020, large companies across the S&P 500 suffered overall earnings declines of 14%. Mid-sized companies across the S&P 400 suffered earnings declines of 31% and small-sized companies suffered earnings declines of 50%. Fortunately, the bounce in the economy and the bounce in demand in 2021 will also precipitate an historic bounce in corporate earnings. Analysts expect large-cap earnings will rise 26%, mid-cap earnings will rise 50% and small-cap earnings will rise an astonishing 80%.

Some will argue that these numbers rely on easy comparisons given the COVID damage in 2020, and opine that you should prepare for meager gains once the calendar flips. To puncture their pessimism, let’s look at profit estimates for 2022. At the moment, analysts expect large-cap earnings to rise another 14%, mid-cap earnings another 15%, and small-cap earnings another 22% in 2022. Oh… and these estimates keep floating higher. Lastly, strong early-cycle earnings expansions tend to crank prolonged earnings growth momentum as seen below:

As post-traumatic earnings cycles begin, demand exceeds supply, profit margins pop, producers use profits to scale, expenses rise which pressures margins, and profit gains descend as the expansion ages. Barring an exogenous event, the profits parade just beginning may indeed slow in time, but it should last a while… and will likely exceed already rosy expectations.