Full Story:

News of viable vaccines powered the markets higher early in the week, only to lose altitude after some vigilant civil servants started re-powering down America. They have a point. COVID case counts have hit record levels, hospitalization rates now exceed April highs and death rates have doubled off of their October lows. The R0 (how many people one person infects) ratio in most jurisdictions sits at critical levels, foretelling higher infection rates still. Remember that 60 million Americans caught the swine flu in 2009. So far, 12 million Americans have caught COVID. This pandemic hasn’t ended. In fact, it’s accelerating. And yet markets seem intrepid. Yes, investors know that an effective vaccine will enter distribution shortly, and yes, they know that constituent pain prompts further stimulus relief, and yes, they know that interest rates pegged at zero force return seekers into the stock market. But there is another, more durable reason for capital’s current courage… corporate earnings.

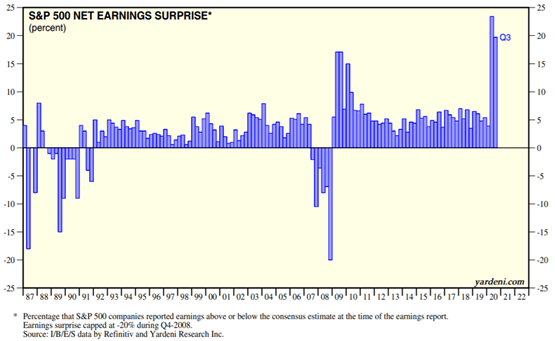

Companies across the S&P 500 earned $163 in 2019. For 2020, analysts expected S&P 500 companies to earn $175. COVID had other plans. Analysts now expect 2020 earnings of $139. For 2021, analysts expect earnings of $169, for a year-over-year gain of 22%. Sound too good to be true? It may not be good enough. The below chart chronicles the difference between analysts’ earnings estimates per quarter and the actual results. As you can see, the past two quarters have registered the highest net earnings surprises on record:

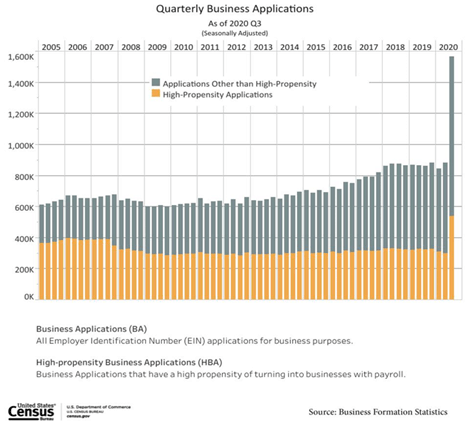

Now don’t confuse earnings surprise with earnings growth. S&P 500 earnings fell 35% in Q2 and 6% in Q3, so things aren’t good – but they are the best they have ever been relative to expectations! Why? First, during times of economic disruption and transition, it’s hard for Wall Street analysts to accurately forecast earnings. This explains the larger net surprise readings in the chart above around the 1987 crash, the 1990 recession, the 2008 great financial crisis and the recovery in 2009. What’s unprecedented about the COVID recession era is that earnings NEVER negatively surprised. Analysts wildly underestimated the resilience and ingenuity of their coverage universe and now lag badly behind reality. With corporations dramatically reducing financing costs, eliminating travel, trimming real estate footprints and rapidly adopting productivity-enhancing technologies, margins, and therefore earnings, should surge as post-COVID revenues return. For smaller companies, these gains have been even more dramatic relative to expectations. In fact, for the current quarter, while the net earnings surprise for large companies (S&P 500) approximates 20%, it approximates 75% for small companies (S&P 600). Across the spectrum, COVID has created the fastest corporate “upgrade” cycle ever. In economics, they call this rapid reengineering “creative destruction” as new processes and new ways of thinking spread like wildfire through an economy. For evidence that this economy has entered a substantial upgrade cycle, consider the historic level of new business originations:

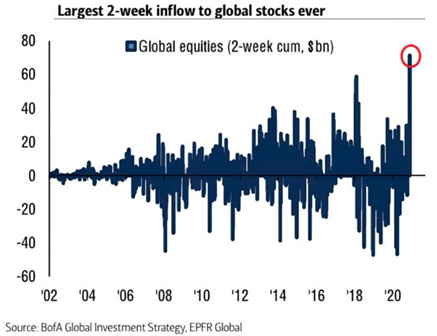

Entrepreneurs start businesses out of necessity or opportunity. Either way, to be competitive against incumbents, they have to offer something novel. Additionally, entrepreneurs begin businesses without the drag of legacy systems or legacy thinking. Historically, a surge in entrepreneur activity leads to a surge in productivity, which leads to a surge in GDP. If GDP estimates are too low, then revenue estimates are too low, and if profit margin estimates are too low then earnings estimates are way too low. Once analysts begin catching up with this, earnings estimates will rise. When earnings estimates rise… markets rise. And based upon the recent panic buying…we are not the only ones aware of this: