The Full Story:

While it’s difficult to point to just one thing that precipitated the cascade lower in tech stocks over the last 10 days, I remember uttering “uh oh” at my desk when Tesla’s board authorized the sale of $5 billion in stock. For us greybeards, a board trying to “cash out” after a parabolic run amounts to introducing a stickpin to a balloon. Four trading days later, Tesla’s shares stood 34% lower. While the shares have recovered somewhat recently, they remain 26% off their recent high. For us, this comeuppance was somewhat welcome news. Market imbalances pose larger threats the larger they become. Furthermore, falling markets reveal the locations of more committed capital. We wrote weeks ago about the inevitable tech unwind and the fallback bunkers investors should inhabit now. To quote ourselves:

…should the next 5 years play out like the early 2000s, which we think they will, investors will be better served by learning to love today’s unloved. Between 2000 and 2005, investors who stuck with S&P 500 growth stocks lost 31% of their capital while those who held S&P 500 value stocks made 13%, those who held emerging market stocks made 24%, those who held small cap stocks made 38%, and those who held the most reviled small cap value stocks made 121%. What created this investable rotation? Excessive valuations in the momentum names, a recession and a recovery, and a persistent decline in the US dollar.

Whether the Tesla $5 billion stickpin marked the top for this tech-centric period of excess remains unknown, what we do know is that we now have the returns data to test our thesis.

What the Data Says

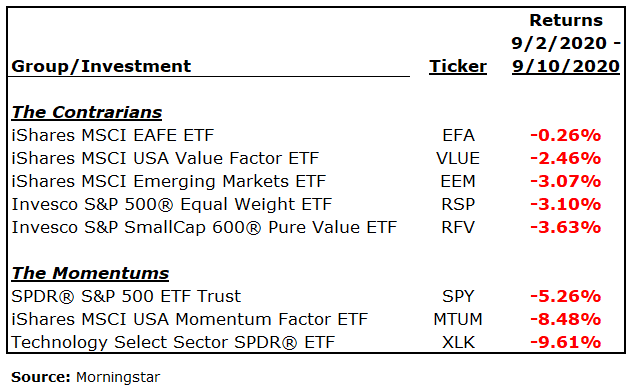

Since September 2nd, the S&P 500 Index has fallen 5.3% while the MSCI Momentum Factor index has fallen 8.5% and the MSCI Value factor index has fallen 2.5%. Advantage Value. Concurrently, the S&P 500 Equal Weight Index (each of the 500 stocks are weighted equally) fell 3.1% vs. the market cap weighted S&P 500 Index down 5.3%. Advantage Small Cap. The Emerging Market Index over the period fell 3.07%. Advantage Emerging Markets. The Small Cap Value index also outperformed, but by the smallest margin in the class with a drop of 3.63%. Advantage Small Cap Value. The overall winner? The developed country international EAFE Index, down a slight .26%. Advantage Europe and Japan. Overall, the contrarians won the day, but the victory was not absolute since they declined as well…the rankings within our contrarian class reveal why.

The US economy, fueled by stimulus and reduced lockdown provisions, will likely expand by 25%+ in the third quarter after shrinking 33% in the second. This dramatic turnaround, and the stimulus it required, justifies the historic run in the markets (contrarian and momentum alike) since the bottom on March 23rd. However, the current stimulus stalemate in Washington creates questions around the recovery pace from here. Small cap value stocks represent the most economically sensitive quadrant of the market. Therefore, the fading odds of follow-on stimulus have de-stimulated the small cap value rally. Similarly, emerging market stocks feed on US dollar weakness and global economic growth. Mandated lockdowns without offsetting stimulus restrain economic growth and the emerging market thesis. It may seem like I am nitpicking since they both outperformed during the sell-off, but to really mark the contrarian turn, we must see conviction surrounding the durability of this economic recovery. Without providing stimulus in exchange for lockdown mandates, this will require the vaccine. Until then, this market may simply crab sideways awaiting election results and policy clarity. For tech investors, this means potentially tradable fits and starts. For contrarian investors, remain vigilant. Our rotation theory has been proven. Should Congress suddenly prioritize the interests of their constituents and pass stimulus, you are well positioned. Should the FDA bless a vaccine, you are well positioned. Either way, while 2020 may have been all about the dominance of the new economy, 2021 will likely be all about the resurgence of the old economy as the world gets back to business.

Have a great weekend!